- Home

- About Us

- The Team / Contact Us

- Books and Resources

- Privacy Policy

- Nonprofit Employer of Choice Award

In a previous article, I asked the question: “Is giving $20 a week generous?” The answer was both yes and no. This discussion adds a third answer: it depends.

In a previous article, I asked the question: “Is giving $20 a week generous?” The answer was both yes and no. This discussion adds a third answer: it depends.

It depends on how much money you make. Statistics Canada has released even more details about charitable giving in Canada for 2022. Let’s dive in, shall we?

Weird comparison to charitable giving and drinking

I find taxfiler data to be the most reliable measurement of charitable giving. There are studies that ask people how much they donate to charity, and people describe themselves as considerably more generous than the income tax data does. Humans forget, we’re not great with numbers, we answer questions based on how we’d like to be.

A weird but helpful comparison here is alcohol consumption. People report drinking much less than liquor sales demonstrate. Charitable giving is the reverse: people self-report giving more than the charitable receipts issued by charities demonstrate. Taxfiler data is based on receipts.

Back to the question: Is $20 a week generous?

Yes, it’s generous

Most Canadians don’t give at all (in a receiptable way). For the minority of Canadians who claim charitable giving receipts, the median donation total for 2022 was $380. Half gave more, half gave less.

$1,000 in annual donations is more generous than the typical Canadian donor for 2022.

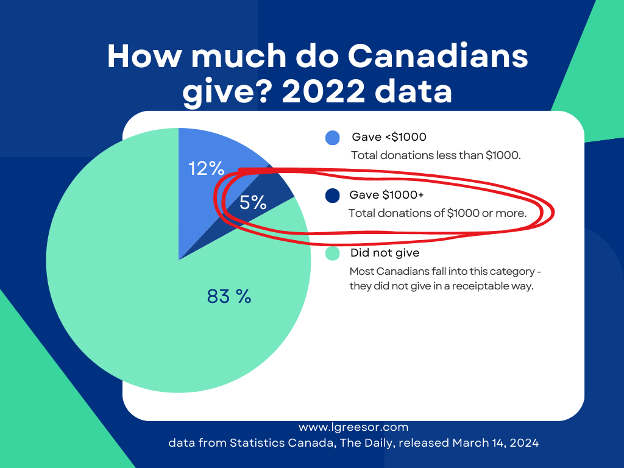

Here’s a pie chart:

$20 a week = $1,000 a year. Only 5% of Canadian tax filers gave $1,000 or more in 2022. These donors tend to be older people who attend religious services regularly. Yes, $20 a week is generous.

No, it’s not generous

That’s a bold claim after that previous chart, no? The new StatsCan data allows one to download the charts as .csv files. Of course, I did!

Let’s zoom in on the smallest slice of the pie - the 5% of tax filers who donated $1,000+. I removed the very few top donors who gave more than $50,000 (insert Lori speech on outliers here…). That left about 1.5 million donors who gave just over $7 billion. Billion with a b. We should pause here to say a hearty “Thanks be to God!” because these donors are carrying many, many places of worship and charities that benefit us all.

Excluding the very top donors, the average for this group was $4,692 (the median is probably lower). That number rings true to me, based on church giving data I’ve seen. It’s this shrinking group of most generous people who make it possible for churches to function well. They compensate for church members who don’t give at all. In comparison to the very small slice of donors who give the most, $1,000 annually isn’t as generous. But it’s much more generous than most Canadians. Confused yet?

It depends

Wait, you say! How can $20/week be generous or not generous?

“$1000 a year looks different if you’re making $40,000 annually compared to if you’re making $100,000,” said a couple of people who responded to my previous article—quite right!

Christians (and other faiths, we didn’t invent this!) believe in proportional giving. If God has given you more, give more. If God has given you less, give less. Give as you are able.

Are you still with me? Can you handle just a few more numbers?

“The median income of charitable donors ($71,240) was significantly higher than the median income of all tax filers ($41,930).”

Eh? A typical donor made about $71,000 in 2022 and gave $380 to charity. I wish there was a way to make that look more generous. It’s about half of one percent. The $20/week donor with a median donor income is giving more, about 1.4%.

Since this is income tax data, StatsCan can look at total income and total giving. When they add it all up, Canadians gave 0.7% of reported income to charity in 2022. Quick refresher on percentages - 0.7% is not 7 cents on the dollar, it’s 7 cents for every 10 dollars, 70 cents for every 100 dollars.

Manitobans—with a big shout out to Winkler and Steinbach, the most generous cities in Canada!—gave 1% of reported income. I’ve talked to donors in both places. I can attest that they are spiritually motivated. Manitobans are not richer than their cousins in Ontario or BC, but their median donations are larger. They are simply more generous.

Generosity results from learning generosity

I get that the cost of living is high. Here’s the thing though: generous people don’t wait until the economy improves. I’ve talked to lots of generous donors. Without exception, they give in grateful response to a generous God. They learned generosity from their family, from their church, from their communities.

Generosity results from learning generosity. It doesn’t just happen. Learning generosity comes from talking about money, seeing your family’s generosity and belonging to a generous congregation that talks about giving. It’s stories, sharing and prayer that build generosity. Generosity is a joyful and life-giving spiritual practice. How can we encourage and nurture generosity around us?

Dr. Lori Guenther Reesor is an author, speaker and generosity coach. A Stats major who went on to study theology and ministry, she wrote “Growing a Generous Church: A Year in the Life of Peach Blossom Church” to encourage churches to talk about money. She blogs at www.lgreesor.com.

Together with her Jewish and Muslim fundraising colleagues, Lori will be speaking at CAGP in Ottawa on April 4th and at AFP ICON in Toronto on Sunday, April 7th.